BTC Price Prediction: Bullish Breakout Likely Amid Institutional Support

#BTC

- Technical Strength: MACD and Bollinger Bands suggest upside potential.

- Institutional Support: Major purchases signal confidence in BTC's long-term value.

- Macro Trends: Weak jobs data and potential rate cuts could fuel further gains.

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Potential Upside

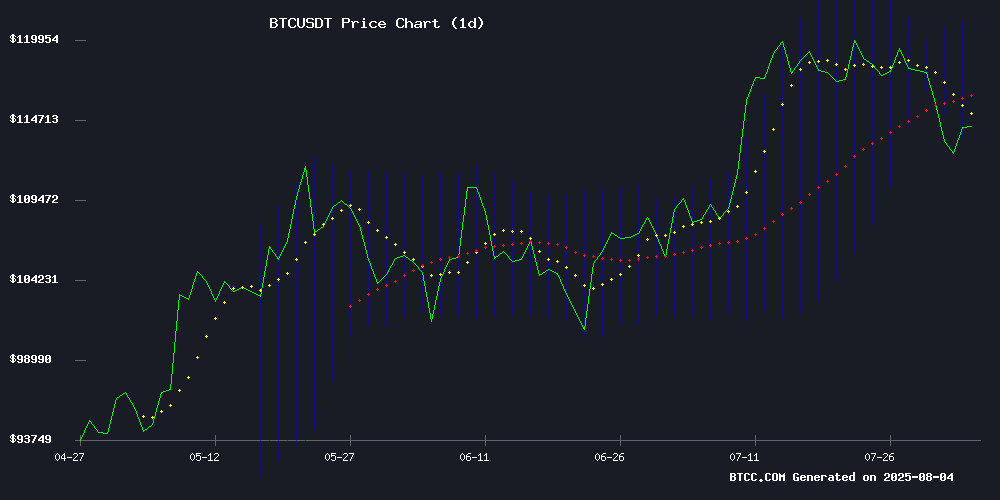

According to BTCC financial analyst James, Bitcoin (BTC) is currently trading at $114,969.69, slightly below its 20-day moving average (MA) of $117,242.99. The MACD indicator shows a bullish crossover with a value of 1,223.97, suggesting upward momentum. Bollinger Bands indicate that BTC is hovering near the middle band ($117,242.99), with the upper band at $121,202.37 and the lower band at $113,283.61. This consolidation near the middle band often precedes a breakout, and given the bullish MACD, a move toward the upper band is plausible.

Market Sentiment: Mixed Signals Amid Macro Uncertainty

BTCC financial analyst James notes that Bitcoin's recent 5% drop in August has tested critical support at $110K, but institutional interest remains strong. News of Metaplanet's $54 million bitcoin purchase and BlockDAG's successful presale highlight growing institutional confidence. However, weak jobs data and political uncertainty have fueled rate cut bets, which could benefit crypto markets. While some traders are reducing risk exposure (evidenced by a $3B leverage unwind in futures), the overall sentiment appears cautiously optimistic as Bitcoin holds steady near $113K.

Factors Influencing BTC’s Price

Bitcoin Tests Critical Support at $110K After 5% August Drop

Bitcoin opened August with a 5% decline, slipping from $118,330 to $112,300 over the weekend. Analysts warn the $110,000 support level—formerly BTC's all-time high—now serves as a make-or-break zone. "Holding above $112,000 keeps retesting record highs plausible," said IG Markets' Tony Sycamore. A breakdown could trigger a slide toward the 200-day moving average near $99,355.

Macroeconomic headwinds compound the pressure. Weak U.S. jobs data and escalating trade tensions have dampened risk appetite across markets. The cryptocurrency's August track record remains notoriously bearish—a pattern that appears intact in early 2025 trading.

Nigeria's Economic Revival and Crypto Surge: A Path to Continental Dominance?

Nigeria's economic landscape is undergoing a seismic shift, with revised GDP figures and a cryptocurrency boom positioning the nation as a potential African leader. The National Bureau of Statistics reports a 3.13% year-on-year GDP growth in Q1 2025, elevating Nigeria's economic output to 372.8 trillion naira ($243 billion). This recalibration—driven by President Bola Tinubu's reforms including naira floatation and fuel subsidy removal—places Nigeria among Africa's top four economies.

Parallel to this macroeconomic resurgence, cryptocurrencies like Bitcoin Hyper ($HYPER) are gaining traction as Nigerians hedge against inflation and fiat volatility. The convergence of institutional reforms and grassroots crypto adoption raises provocative questions about Nigeria's capacity to leverage blockchain technology for economic supremacy. Market observers note that Nigeria's informal economy, now captured in official statistics, mirrors the decentralized ethos driving its crypto revolution.

Weak Jobs Data and Trump's Fed Moves Fuel Rate Cut Bets, Crypto Markets Poised to Benefit

Markets reeled as July's jobs report revealed a meager 73,000 nonfarm payroll additions—just half of expectations. The Bureau of Labor Statistics quietly revised May and June figures downward by 258,000 combined, triggering a swift repricing of Fed expectations. CME's FedWatch now prices a 78.5% probability of a September rate cut, up from sub-40% last week. BlackRock's Rick Rieder speculates the Fed could deliver an aggressive 50bps cut.

President Trump escalated tensions by firing BLS chief Erika McEntarfer post-report, drawing bipartisan criticism. With Adriana Kugler's Fed resignation creating a vacancy, the administration appears poised to reshape monetary policy oversight. These developments create fertile ground for crypto assets, as looser liquidity typically fuels risk appetite. Bitcoin and altcoins may find fresh momentum if the Fed follows through with dovish moves.

Bitcoin's $166K Target Gains Credence as Fibonacci Pattern Holds

Bitcoin's price trajectory continues to mirror Fibonacci extension levels with uncanny precision, suggesting a potential climb to $166,754. The 5.618 Fibonacci level now serves as the next technical magnet after BTC's methodical progression through $30,362, $46,831, $71,591 and $109,236 checkpoints since its 2022 low.

Institutional capital flows remain the invisible hand propelling prices upward. U.S. spot Bitcoin ETFs now safeguard nearly $150 billion in assets, creating structural demand that overwhelms typical sell-side pressure. Yet September's historical volatility looms—seasonal data reveals consistent mid-cycle corrections that could interrupt the ascent.

The market's current 7% retreat from $123,000 appears as a comma rather than a full stop. As CryptoCon's model demonstrates, Fibonacci sequences have dictated Bitcoin's rhythm for two years running. This time may prove no different.

BlockDAG Unveils Live Trading Dashboard Amid $361M Presale Success

BlockDAG is transforming crypto presale dynamics by delivering functional trading tools ahead of its official launch. The project's newly released Trading Dashboard (V4) enables users to simulate exchange activity—executing buy/sell orders, tracking price movements, and analyzing order books in real time. This operational infrastructure contrasts sharply with speculative presale projects, positioning BDAG as a tangible investment opportunity.

The presale has already generated $361 million with 24.6 billion BDAG tokens sold, delivering 2,660% returns since Batch 1. A limited $0.0016 entry price remains available despite Batch 29's $0.0276 valuation. The TRADEBDAG activation code grants immediate dashboard access, further bridging the gap between promise and utility.

Metaplanet Expands Bitcoin Holdings with $54 Million Purchase, Nearing $2 Billion Total

Japanese investment firm Metaplanet has intensified its Bitcoin strategy with a 463 BTC acquisition worth approximately $54 million, executed at an average price of $115,895 per coin. The purchase, announced on August 4, 2025, brings Metaplanet's total holdings to 17,595 BTC—valued at roughly $1.78 billion—and marks the first major corporate Bitcoin buy of the month.

CEO Simon Gerovich revealed the firm has achieved a staggering 459% year-to-date yield on its Bitcoin investments. The acquisition was funded through capital market activities, including a recent $3.7 billion perpetual preferred shares offering. Metaplanet mirrors the aggressive Bitcoin accumulation tactics of U.S.-based Strategy (formerly MicroStrategy), positioning itself as Asia's foremost corporate BTC holder.

Missing Satoshi Nakamoto Statue Recovered in Lugano After Lake Retrieval

The iconic Satoshi Nakamoto statue, a visual illusion crafted by Italian artist Valentina Picozzi, has been recovered from a lake in Lugano after being reported stolen on August 3. Satoshigallery, the project behind the artwork, announced the retrieval on X, offering a 0.1 BTC reward for assistance in locating the statue.

The theft, initially flagged by X user @Grittoshi, was speculated to stem from Swiss National Day celebrations. The statue, unveiled in October 2024 as part of Lugano's push to establish itself as a global Bitcoin hub, symbolizes the pseudonymous creator of Bitcoin. Satoshigallery reaffirmed its commitment to installing the statue in 21 locations worldwide, declaring, "You can steal our symbol but you will never be able to steal our souls."

Bitcoin Rebounds After Tariff-Led Selloff Amid Macro Uncertainty

Bitcoin stabilizes above $114,000 following a volatile week marked by macroeconomic headwinds. Weak U.S. job data and escalating trade tensions initially triggered a 3% pullback, but persistent ETF inflows and institutional accumulation suggest underlying strength.

The cryptocurrency now trades at $114,754, recovering 0.91% in 24 hours despite political turbulence surrounding labor statistics. Market sensitivity to risk appetite remains Bitcoin's primary price driver during periods of economic uncertainty.

Technical indicators show BTC testing key support levels as traders weigh conflicting signals - bearish macro sentiment versus bullish on-chain fundamentals. The $140,000 August price target now hinges on whether institutional demand can outweigh broader market jitters.

Bitcoin: Calm Before the Storm or Just a Technical Rebound?

Bitcoin's price action remains a study in contrasts as August unfolds. The $116,500 level has emerged as a critical battleground, with miners accumulating $1.66 billion worth of BTC in July alone. This threshold now serves as both a technical magnet and a potential liquidation zone for overextended shorts.

Long-term holders continue accumulating despite recent volatility, betting on a return to all-time highs. Institutional demand patterns and on-chain metrics suggest explosive upside potential—with $75,000 appearing increasingly plausible if key resistance breaks.

The market's nervous energy reflects deeper macroeconomic uncertainties. Traders oscillate between anticipating another bullish cycle and preparing for a deeper correction. What's undeniable is Bitcoin's enduring ability to command attention through both technical signals and fundamental developments.

Bitcoin Holds Steady Near $113K Amid Fed Policy Clarity and Institutional Support

Bitcoin stabilized near $113,000 after a brief dip below $112,000, as the Federal Reserve maintained interest rates and unveiled a new U.S. crypto strategy. The largest cryptocurrency recovered from a low of $111,903, trading around $113,430 at press time. Despite slipping from recent highs near $119,000, Bitcoin remains up 25% year-to-date, outpacing major U.S. stock indices.

The Fed's decision to hold rates at 4.25%-4.5% marked its first split vote since 1993, with two governors advocating for a cut. Regulatory clarity and institutional backing continue to buoy sentiment, even as ETF outflows and labor data revisions introduced short-term volatility.

Bitcoin Futures See $3B Leverage Unwind as Traders Reduce Risk Exposure

Bitcoin futures markets opened August with a sharp deleveraging event, shedding $3.78 billion in open interest as traders pared back speculative positions. The contraction coincided with a modest 2.8% BTC price decline, suggesting deliberate risk management rather than forced liquidations.

CME's institutional flows remained steady while retail-dominated platforms saw concentrated outflows. The August 3rd session proved particularly telling—a mere $732 BTC price drop triggered a $3 billion OI reduction, underscoring traders' cautious stance amid muted spot volatility.

How High Will BTC Price Go?

BTCC financial analyst James suggests that Bitcoin could target $121,202 (upper Bollinger Band) in the near term, with a potential longer-term rally toward $166K if the Fibonacci pattern holds. Key factors supporting this outlook include:

| Factor | Impact |

|---|---|

| Bullish MACD Crossover | Positive Momentum |

| Institutional Buying (e.g., Metaplanet) | Increased Demand |

| Rate Cut Expectations | Macro Tailwinds |